maricopa county tax liens for sale

Web Maricopa County AZ currently has 18506 tax liens available as of November 17. On a CD from the Research Material Buying Guide available at the beginning of January.

Confirmation of lien purchases will be sent by email.

. County Information Assessor Information Records Information. Web Maricopa County AZ currently has 14 tax liens available as of June 15. The Tax Lien Sale provides for the payment of delinquent property taxes by an investor.

Web There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available for sale or. Web Maricopa County Tax Lien Sale Information. Web Maricopa County Treasurer Attention Tax Lien Department 301 W.

Web The Maricopa County Treasurers Office does not guarantee the positional accuracy of the Assessors parcel boundaries displayed on the map. Web Maricopa AZ currently has 712 tax liens available as of October 23. Confirmation of lien purchases will be sent by email.

301 West Jefferson Street. Web Download the Previously Offered Tax Deeded Land - NOT SOLD PDF. The Maricopa County Treasurers Tax Lien Web application allows you to monitor your CP Buyer account with Maricopa County.

Web Maricopa County Treasurer Attention Tax Lien Department 301 W. Nationwide tax lien management platform. When a Maricopa County AZ tax lien is issued for unpaid past due balances Maricopa.

Web ARIZONA - Maricopa County Tax Lien Sale. Jefferson St Suite 140 Phoenix AZ 85003. Web We hope you enjoyed Teds lesson How to Buy Tax Liens in Maricopa County Maricopa County pays up to 16 for tax lien certificates which are sold via a bid down auction.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent. The Tax Lien Sale will be. Web There are currently 11375 tax lien-related investment opportunities in Maricopa County AZ including tax lien foreclosure properties that are either available.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax. These buyers bid for an interest rate on the taxes owed and the. How does a tax lien sale work.

Web If the delinquent owner redeems the property the investor receives a payment of what they paid for the tax lien certificate less the processing fee plus the prorated. For additional information on Tax Deeded Land Sales you may contact the Treasurers Office at. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

Web Tax liens on parcels with unpaid taxes are put up for sale. Jefferson St Suite 140 Phoenix AZ 85003. Web Tax Lien Web.

Web Interested in a tax lien in Maricopa County AZ.

Fill Free Fillable Forms Maricopa County Telecommunications

Displaced In America Housing Loss In Maricopa County Arizona

How To Buy Tax Liens In Maricopa County Youtube

Az Tax Liens And Tax Foreclosures Arizona Real Estate License Exam Prep Youtube

Maricopa County Treasurer Flora Resigns In Disgust With Board Of Supervisors Arizona Daily Independent

Arizona Owners Can Lose Homes Over As Little As 50 In Back Taxes

Faq On Real Property Tax Lien Foreclosures Hymson Goldstein Pantiliat Lohr Pllc

Maricopa County Trustee Deed Foreclosure Form Arizona Deeds Com

Tax Lien Facts Us Tax Lien Association

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Arizona Tax Liens Maricopa County Tax Lien Research Tutorial

The Essential List Of Tax Lien Certificate States

Auctions Leases Maricopa County Az

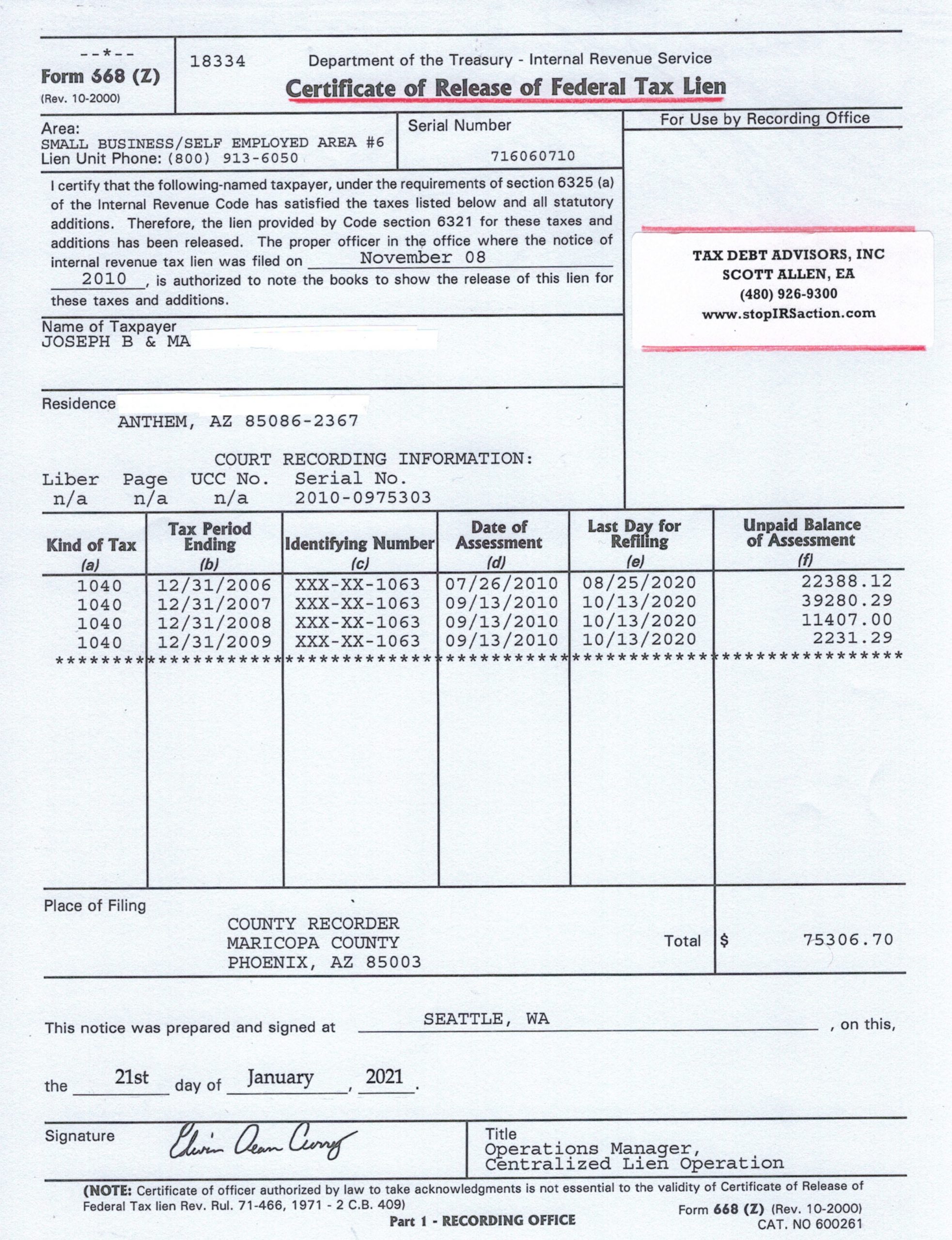

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Maricopa County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates